These figures, when carried in the above formula, gives us the following: Advertisements

Let’s suppose a company has an opening inventory of $500, further purchases of $200 are done, and the closing balance at the yearend is $300. And it is not in compliance with the matching principle, resulting in the over or understated profit during the period. If it is not consistent, then the cost of goods sold and revenues will be recognized in the financial statements in a different period. Recognition of cost of goods sold and derecognition of finished goods (Inventories) should also be consistent with the recognition of sales. Related article Cost of Goods Sold for Catering Business - Explained Here is the entry when the goods are sold,Īs explained, the debit cost of goods sold will increase the cost of goods sold in the income statement, and credit to finish goods will decrease the balance of finished goods in the balance sheet. The cost of goods sold is also increased by incurring costs on direct labor. The inventory account is of a debit nature, and crediting it will decrease the value of closing inventory. Once the inventory is issued to the production department, the cost of goods sold is debited while the inventory account is credited.Īs the cost of goods sold is a debit account, debiting it will increase the cost of goods sold and reduce the company’s profits. Once any of the above methods complete the inventory valuation, it should be recorded by a proper journal entry. Advertisements Journal entry for cost of goods These are feasible in only certain industries such as car manufacturers, real estate businesses, furniture, and other on-demand manufacturers industries. In this method of valuation of inventory, the company values the cost of goods sold and closing inventory at a specific cost specially identified for a specific product. The weighted average cost method measures the value of the cost of goods sold and closing inventory at a rate such that the cost of total inventory purchased is divided by the total units in the inventory. The cost of goods sold is measured according to the prior inventory purchased rather than the recent one.

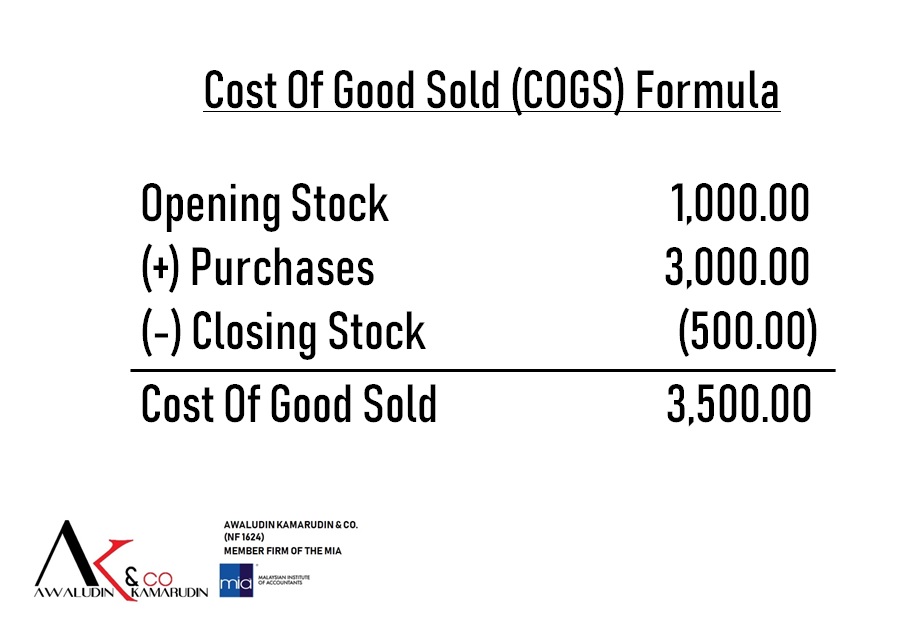

Related article What Makes the Cost of Goods Sold Decrease? Advertisements First in First Out Method ofįirst in, the first out method values inventory at the earliest value of inventory. These are the first in, first out, weighted average cost method, and specific identification method. Inventory consumed can be valued by many different methods. However, before passing a journal entry, this is necessary to find the value of inventory consumed. This COGS formula, when adjusted with the corresponding figures, gives a final figure for the cost of goods sold. The following COGS formula can find this.Ĭost of Goods Sold = Beginning inventory + Purchases – Closing Inventory To record the cost of goods sold, we need to find its value before we process a journal entry. Accounting for costs of goods sold in financial statements:

Costs of goods sold vary as the number of finished products increase or decreases.Ĭosts of goods sold do not include other materials or labor costs other than the production process or are indirect to the production of finished products and do not vary with the quantity of finished stock produced.īelow is the explanation of how the cost of goods sold is recorded in the form of double entries in the company management account or financial statements. The figure for the cost of goods sold only includes the costs for the items sold during the period and not the finished goods that are not still sold or billed by customers.

Costs of goods sold only include the directly associated costs of inventory and labor. The cost of goods sold is the direct costs incurred on the production of items manufactured and then sold.

0 kommentar(er)

0 kommentar(er)